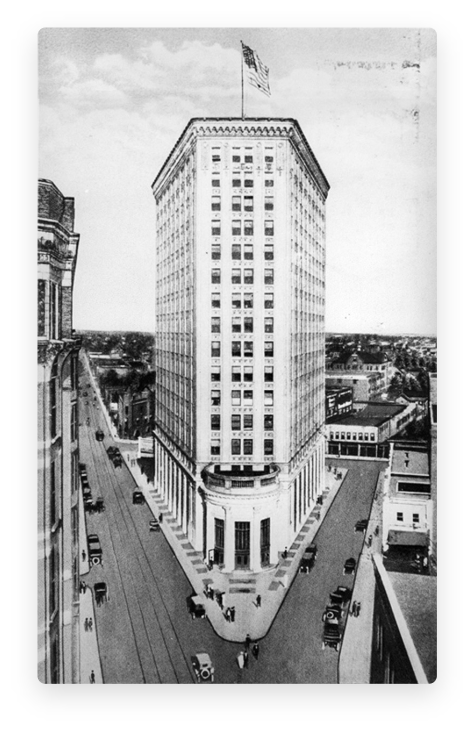

Early 1900S

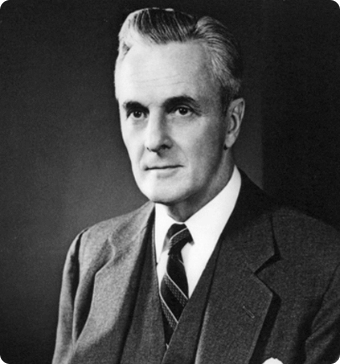

Leadership From The Start

Richard W. “DIck” Courts, Jr attends the University of Georgia, where he was selected for membership in Phi Beta Kappa and Sphinx.

During World War I, Dick Courts served in France as a 2nd lieutenant with the U.S. 343rd Infantry Regiment.